Complement 3 Glomerulopathy Market Poised for Phenomenal Expansion at a CAGR of 37.2% During the Forecast Period (2025–2034) Owing to the Launch of Promising Therapies Targeting C3, C5, MASP-3, and RNAi | DelveInsight

The complement 3 glomerulopathy market is poised for steady growth, driven by increasing disease awareness, advances in complement pathway research, and rising diagnostic rates. The lack of approved targeted therapies has spurred significant R&D investment in complement inhibitors and novel biologics. Pipeline therapies such as KP104 (Kira Pharmaceuticals), Zaltenibart (Omeros Corporation), Ruxoprubart (NovelMed Therapeutics), ARO-C3 (Arrowhead Pharmaceuticals), and others are expected to reshape the treatment landscape over the next decade.

New York, USA, Oct. 22, 2025 (GLOBE NEWSWIRE) -- Complement 3 Glomerulopathy Market Poised for Phenomenal Expansion at a CAGR of 37.2% During the Forecast Period (2025–2034) Owing to the Launch of Promising Therapies Targeting C3, C5, MASP-3, and RNAi | DelveInsight

The complement 3 glomerulopathy market is poised for steady growth, driven by increasing disease awareness, advances in complement pathway research, and rising diagnostic rates. The lack of approved targeted therapies has spurred significant R&D investment in complement inhibitors and novel biologics. Pipeline therapies such as KP104 (Kira Pharmaceuticals), Zaltenibart (Omeros Corporation), Ruxoprubart (NovelMed Therapeutics), ARO-C3 (Arrowhead Pharmaceuticals), and others are expected to reshape the treatment landscape over the next decade.

DelveInsight’s Complement 3 Glomerulopathy Market Insights report includes a comprehensive understanding of current treatment practices, emerging complement 3 glomerulopathy drugs, market share of individual therapies, and current and forecasted complement 3 glomerulopathy market size from 2020 to 2034, segmented into leading markets (the US, EU4, UK, and Japan).

Complement 3 Glomerulopathy Market Summary

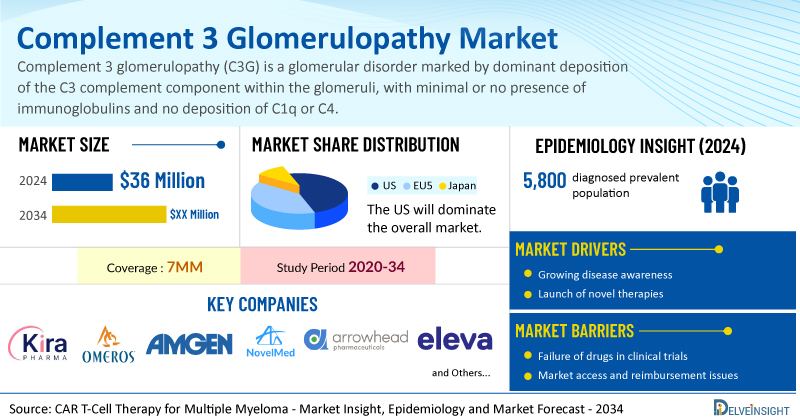

- The market size for complement 3 glomerulopathy was found to be USD 36 million in the leading markets in 2024.

- The United States accounted for the largest complement 3 glomerulopathy treatment market size, approximately 73% of the total market size in the 7MM in 2024, compared to other major markets, including the EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- In 2024, the diagnosed prevalent population of C3 glomerulopathy in the 7MM was approximately 5,800. This number is expected to rise through 2034, driven by advances in complement biology, improved diagnostics, and wider use of genetic testing, complement assays, and multidisciplinary biopsy evaluation.

- Key complement 3 glomerulopathy companies, including Kira Pharmaceuticals, Omeros Corporation, Amgen, NovelMed Therapeutics, Arrowhead Pharmaceuticals, Eleva, and others, are actively working on innovative complement 3 glomerulopathy drugs.

- Some of the key complement 3 glomerulopathy therapies in clinical trials include KP104, Zaltenibart (OMS906), TAVNEOS (avacopan), Ruxoprubart (NM8074), ARO-C3, CPV-104, and others. These novel complement 3 glomerulopathy therapies are anticipated to enter the complement 3 glomerulopathy market in the forecast period and are expected to change the market.

Discover which complement 3 glomerulopathy medications are expected to grab the market share @ Complement 3 Glomerulopathy Market Report

Key Factors Driving the Growth of the Complement 3 Glomerulopathy Market

Growing C3G Patient Population

In 2024, the diagnosed prevalent population of C3 glomerulopathy in the 7MM was approximately 5,800. This number is expected to rise through 2034, driven by advances in complement biology, improved diagnostics, and wider use of genetic testing, complement assays, and multidisciplinary biopsy evaluation.

Advancements in Targeted Therapies

The development of targeted therapies, such as complement inhibitors, has improved treatment options for C3G. These therapies aim to regulate the complement system, addressing the underlying cause of the disease. Notable drugs in this category include Pegcetacoplan (EMPAVELI/ ASPAVELI) and Iptacopan (FABHALTA/ FABIHARTA), which have shown promise in clinical trials.

Expected Launch of C3G Drugs

Key players such as Kira Pharmaceuticals (KP104), Omeros Corporation (Zaltenibart [OMS906]), NovelMed Therapeutics (Ruxoprubart [NM8074]), Arrowhead Pharmaceuticals (ARO-C3), and others are currently developing drugs for C3G. These therapies are expected to create an upward shift in the C3G treatment market after their launch in the coming years, in the 7MM.

Emergence of Novel Mechanisms in C3G

Emerging therapies targeting novel mechanisms such as dual complement inhibitors (C5 and Factor H (KP104), MASP-3 inhibitors (Zaltenibart), RNA interference (RNAi) therapeutics targeting complement C3 (ARO-C3), and others are showing promise as potential treatment options.

Complement 3 Glomerulopathy Market Analysis

The management of C3G largely depends on the off-label use of multiple prescription medications, underscoring the significant unmet need for approved and targeted treatments. Current therapeutic strategies primarily involve immunosuppressants, corticosteroids, Renin-Angiotensin-Aldosterone System (RAAS) inhibitors, and supportive agents like calcineurin inhibitors and monoclonal antibodies.

Additional off-label approaches include the use of monoclonal antibodies such as eculizumab and rituximab, which act on the terminal complement pathway by inhibiting C5, leading to improved kidney function and reduced proteinuria.

FABHALTA was the first drug to receive approval for C3G treatment, followed by EMPAVELI/ASPAVELI, developed by Apellis Pharmaceuticals and Sobi. Nonetheless, both therapies face a key limitation, black box warnings for potentially fatal infections caused by encapsulated bacteria (e.g., Neisseria meningitidis, Streptococcus pneumoniae, and Haemophilus influenzae type b), requiring patients to be vaccinated at least two weeks prior to therapy initiation.

EMPAVELI/ASPAVELI represents a promising treatment option by targeting C3 directly and upstream in the complement cascade. It has demonstrated superior clinical efficacy, nearly doubling the therapeutic benefits achieved with FABHALTA, setting a new benchmark for treatment effectiveness.

Meanwhile, emerging investigational therapies focusing on novel mechanisms, such as dual complement inhibition (C5 and Factor H; KP104), MASP-3 inhibition (Zaltenibart), and RNA interference (RNAi) therapeutics targeting complement C3 (ARO-C3), are showing encouraging potential as future treatment options.

Learn more about the complement 3 glomerulopathy treatment options @ Complement 3 Glomerulopathy Treatment Market

Complement 3 Glomerulopathy Competitive Landscape

The emerging pipeline of C3G holds a few significant products in development by prominent key players such as Kira Pharmaceuticals (KP104), Omeros Corporation (Zaltenibart [OMS906]), NovelMed Therapeutics (Ruxoprubart [NM8074]), Arrowhead Pharmaceuticals (ARO-C3), and others.

Kira Pharmaceuticals’ KP104 is a potent, first-in-class bifunctional biologic engineered to concurrently and selectively inhibit both the alternative and terminal complement pathways. This dual mechanism offers a robust and synergistic approach to addressing key drivers of complement-mediated diseases. The therapy is advancing into Phase II proof-of-concept studies across multiple high-need indications, including IgA nephropathy (IgAN), C3 glomerulopathy (C3G), systemic lupus erythematosus-associated thrombotic microangiopathy (SLE-TMA), and paroxysmal nocturnal hemoglobinuria (PNH). These global Phase II trials will take place in the United States, China, Australia, and South Korea.

Omeros Corporation’s Zaltenibart is an investigational human monoclonal antibody that targets mannan-binding lectin-associated serine protease-3 (MASP-3), a critical upstream activator of the complement system’s alternative pathway. Upon successful completion of the Phase II trial and demonstration of strong efficacy, Omeros Corporation intends to initiate a Phase III study in C3G.

The anticipated launch of these emerging complement 3 glomerulopathy therapies are poised to transform the complement 3 glomerulopathy market landscape in the coming years. As these cutting-edge complement 3 glomerulopathy therapies continue to mature and gain regulatory approval, they are expected to reshape the complement 3 glomerulopathy market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about new treatment for complement 3 glomerulopathy, visit @ Complement 3 Glomerulopathy Medication

Recent Developments in the Complement 3 Glomerulopathy Market

- In July 2025, the FDA approved pegcetacoplan for the treatment of C3G and primary IC-MPGN in patients aged 12 years and older.

- In June 2025, Apellis Pharmaceuticals presented new data from the open-label period of the Phase III VALIANT study, investigating pegcetacoplan for C3G and primary IC-MPGN. The data were presented as part of a late-breaking session at the ERA Congress.

- In April 2025, Novartis announced that the CHMP of the EMA had adopted a positive opinion and recommended granting a marketing authorization for iptacopan for the treatment of adults with C3G.

- In March 2025, Novartis announced that oral iptacopan had received US FDA approval for the treatment of adults with C3G, to reduce proteinuria based on the Phase III APPEAR-C3G trial.

What is Complement 3 Glomerulopathy?

Complement 3 glomerulopathy (C3G) is a glomerular disorder marked by dominant deposition of the C3 complement component within the glomeruli, with minimal or no presence of immunoglobulins and no deposition of C1q or C4. The accumulation of C3, in the absence of classical or lectin pathway components, indicates that the disease arises from dysregulation of the alternative complement pathway. The presence of C3 deposits without significant immunoglobulin, in a patient showing typical signs of glomerulonephritis, serves as the defining diagnostic feature. Due to its rarity, accurate estimates of the incidence and prevalence of C3G are difficult to obtain, and current figures are based on small cohort studies with limited reliability.

Complement 3 Glomerulopathy Epidemiology Segmentation

The complement 3 glomerulopathy epidemiology section provides insights into the historical and current complement 3 glomerulopathy patient pool and forecasted trends for the leading markets. The diagnosed prevalent population of C3G, in the United States, was found to be 3,400 in 2024.

The complement 3 glomerulopathy market report proffers epidemiological analysis for the study period 2020–2034 in the leading markets segmented into:

- Total Diagnosed Prevalent Population of C3G

- Type-specific Diagnosed Prevalent Population of C3G

- Age-specific Diagnosed Prevalent Population of C3G

- Total Treated Cases of C3G

Download the report to understand complement 3 glomerulopathy management @ Complement 3 Glomerulopathy Treatment Options

| Complement 3 Glomerulopathy Market Report Metrics | Details |

| Study Period | 2020–2034 |

| Complement 3 Glomerulopathy Market Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Complement 3 Glomerulopathy Market CAGR | 37.2% |

| Complement 3 Glomerulopathy Market Size by 2034 | USD 1 Billion |

| Key Complement 3 Glomerulopathy Companies | Kira Pharmaceuticals, Omeros Corporation, Amgen, NovelMed Therapeutics, Arrowhead Pharmaceuticals, Eleva, Novartis, Apellis Pharmaceuticals, Sobi, and others |

| Key Complement 3 Glomerulopathy Therapies | KP104, Zaltenibart (OMS906), TAVNEOS (avacopan), Ruxoprubart (NM8074), ARO-C3, CPV-104, FABHALTA/ FABIHARTA, EMPAVELI/ ASPAVELI, and others |

Scope of the Complement 3 Glomerulopathy Market Report

- Complement 3 Glomerulopathy Therapeutic Assessment: Complement 3 Glomerulopathy current marketed and emerging therapies

- Complement 3 Glomerulopathy Market Dynamics: Conjoint Analysis of Emerging Complement 3 Glomerulopathy Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Complement 3 Glomerulopathy Market Unmet Needs, KOL’s views, Analyst’s views, Complement 3 Glomerulopathy Market Access and Reimbursement

Discover more about complement 3 glomerulopathy drugs in development @ Complement 3 Glomerulopathy Clinical Trials

Table of Contents

| 1 | Complement 3 Glomerulopathy Market Key Insights |

| 2 | Complement 3 Glomerulopathy Market Report Introduction |

| 3 | Executive Summary of C3G |

| 4 | Key Events |

| 5 | Epidemiology and Market Forecast Methodology |

| 6 | C3G Market Overview at a Glance |

| 6.1 | Clinical Landscape (Analysis by Molecule Type, Phase, and Route of Administration [RoA]) |

| 6.2 | Market Share (%) Distribution of C3G in 2024 in the 7MM |

| 6.3 | Market Share (%) Distribution of C3G in 2034 in the 7MM |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Familiar Forms of C3G |

| 7.3 | Complement 3 Glomerulopathy Causes and Risk Factors |

| 7.4 | Complement 3 Glomerulopathy Symptoms |

| 7.5 | Complement 3 Glomerulopathy Pathophysiology |

| 7.6 | Complement 3 Glomerulopathy Pathogenesis |

| 7.7 | Complement 3 Glomerulopathy Diagnosis |

| 7.8 | Complement 3 Glomerulopathy Differential Diagnosis |

| 8 | Complement 3 Glomerulopathy Treatment |

| 8.1 | Algorithm for Diagnosis and Management of C3G |

| 8.2 | Clinical Practice Guideline for the Management of Glomerular Diseases: KDIGO 2021 |

| 9 | Epidemiology and Patient Population |

| 9.1 | Key Findings |

| 9.2 | Assumptions and Rationales |

| 9.3 | Total Diagnosed Prevalent Population of C3G in the 7MM |

| 9.4 | The United States |

| 9.4.1 | Total Diagnosed Prevalent Population of C3G in the United States |

| 9.4.2 | Type-specific Diagnosed Prevalent Population of C3G in the United States |

| 9.4.3 | Age-specific Diagnosed Prevalent Population of C3G in the United States |

| 9.4.4 | Total Treated Cases of C3G in the United States |

| 9.5 | EU4 and the UK |

| 9.6 | Japan |

| 10 | Complement 3 Glomerulopathy Patient Journey |

| 11 | Marketed Complement 3 Glomerulopathy Therapies |

| 11.1 | Key Cross of Marketed Therapies |

| 11.2 | Iptacopan (FABHALTA/FABIHARTA): Novartis |

| 11.2.1 | Product Description |

| 11.2.2 | Regulatory Milestones |

| 11.2.3 | Other Developmental Activities |

| 11.2.4 | Summary of Pivotal Trials |

| 11.2.5 | Clinical Development |

| 11.2.6 | Safety and Efficacy |

| 11.2.7 | Analyst Views |

| 11.3 | Pegcetacoplan (EMPAVELI/ ASPAVELI): Apellis Pharmaceuticals and Sobi |

| 12 | Emerging Complement 3 Glomerulopathy Drugs |

| 12.1 | Key Cross Competition |

| 12.2 | KP104: Kira Pharmaceuticals |

| 12.2.1 | Product Description |

| 12.2.2 | Clinical Development |

| 12.2.3 | Analyst Views |

| 12.3 | Zaltenibart (OMS906): Omeros Corporation |

| 12.4 | Ruxoprubart (NM8074): NovelMed Therapeutics |

| 12.5 | ARO-C3: Arrowhead Pharmaceuticals |

| 13 | C3G Market: 7MM Analysis |

| 13.1 | Key Findings |

| 13.2 | Total Market Size of C3G in the 7MM |

| 13.3 | Complement 3 Glomerulopathy Market Outlook |

| 13.4 | Conjoint Analysis |

| 13.5 | Key Complement 3 Glomerulopathy Market Forecast Assumptions |

| 13.6 | The United States Complement 3 Glomerulopathy Market Size |

| 13.6.1 | Total Market Size of C3G in the United States |

| 13.6.2 | Total Market Size of C3G by Therapies in the United States |

| 13.7 | EU4 and the UK Complement 3 Glomerulopathy Market Size |

| 13.8 | Japan Complement 3 Glomerulopathy Market Size |

| 14 | Complement 3 Glomerulopathy Market Unmet Needs |

| 15 | Complement 3 Glomerulopathy Market SWOT Analysis |

| 16 | KOL Views on Complement 3 Glomerulopathy |

| 17 | Complement 3 Glomerulopathy Market Access and Reimbursement |

| 17.1 | The United States |

| 17.2 | In EU4 and the UK |

| 17.3 | Japan |

| 17.4 | Summary and Comparison of Market Access and Pricing Policy Developments in 2025 |

| 17.5 | Market Access and Reimbursement of C3G Therapies |

| 18 | Bibliography |

| 19 | Complement 3 Glomerulopathy Market Report Methodology |

Related Reports

Complement 3 Glomerulopathy Clinical Trial Analysis

Complement 3 Glomerulopathy Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key Complement 3 Glomerulopathy companies, including ChemoCentryx, Novartis Pharmaceuticals, Omeros Corporation, Apellis Pharmaceuticals, among others.

Immune Complex Membranoproliferative Glomerulonephritis Market

Immune Complex Membranoproliferative Glomerulonephritis Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key IC-MPGN companies, including Novartis Pharmaceuticals, Apellis Pharmaceuticals, among others.

IgA Nephropathy Market Insight, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the market trends, market drivers, market barriers, and key IgAN companies, including Novartis, F. Hoffmann-La Roche, Ionis Pharmaceuticals, AstraZeneca (Alexion Pharmaceuticals), Vertex Pharmaceuticals, Otsuka Pharmaceutical, Biogen, Arrowhead Pharmaceuticals, NovelMed, Q32 Bio, Walden Biosciences, Takeda Pharmaceutical, Vera Therapeutics, among others.

Glomerulonephritis Market Insight, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the market trends, market drivers, market barriers, and key glomerulonephritis companies, including Alentis Therapeutics, Takeda Pharmaceutical, Biogen, Novartis, Nkarta, Vertex Pharmaceuticals, Vera Therapeutics, Sobi, Travere Therapeutics, among others.

Glomerulonephritis Clinical Trial Analysis

Glomerulonephritis Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key glomerulonephritis companies, including Alentis Therapeutics, Takeda Pharmaceutical, Biogen, Novartis, Nkarta, Vertex Pharmaceuticals, Vera Therapeutics, Sobi, Travere Therapeutics, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.